Determine the net income for each period 3. Credit pass in mathematics is a basic and compulsory requirement for any. When considering a home purchase, or a mortgage refinance for that matter, knowing the true value of the subject property is paramount. Set up cash flow over period of time (Cash flow money going in and out) 2. It is an important tool for real estate investment decision and property valuation. You can also add, subtraction, multiply, and divide and complete any arithmetic you need. The Math Calculator will evaluate your problem down to a final solution. Enables us to Timing issues (duration of exposure) Risk factors (tenant moving out, equipment failure) To construct a DCF you need to have an appreciation for market value, interest rates etc. Step 1: Enter the expression you want to evaluate. Used to consider what to pay for a property, all things considered. Types of Interest Simple Interest Interest paid only on original amount Compound Interest Interest paid on both original amount and interest Discounted Cash Flow (DCF) An investment evaluation technique based upon the time value of money. Partial payment mortgage payments (PMT) level of periodic payment required for both principle and interest on a loan for for a given period of time with interest at a given rate payment factor (partial interest and principle) any more is solely on interest more you pay the quicker the loan is payed off Time allows the opportunity to postpone consumption and earn interest.

MATH PROPERTY EVALUATOR SERIES

Present value of per period (PVA) present value of a series of future payments for a given period of time discounted at a given rate of interest ((1 i) n ) 6. Sinking fund factor of funds set aside for capital expenses you have much you need to set aside to have a specific amount at any future time FV 1 ) 4.

UBC/AIC Post-Graduate Certificate in Real Property Valuation program (PGCV): The PGCV offers an. Future value of per period annuities or regular payments (FVA) amount to which a series of installments will grow in a given number of periods with interest at a given rate 1 Earning is the total earned minus total invested 3. BUSI 121: Foundations of Real Estate Mathematics OR. Future value of (FV) amount to which will grow in a given period of time including the accumulation of interest at a given rate PV (1 2. Time Value Of Money 6 Functions of the 1. techniques, and mathematical procedures that an appraiser uses to value an.

What a dollar will buy you today will not buy next year. An investor who purchases income-producing property is essentially trading. Middle School Math Solutions Simultaneous Equations Calculator.

MATH PROPERTY EVALUATOR FREE

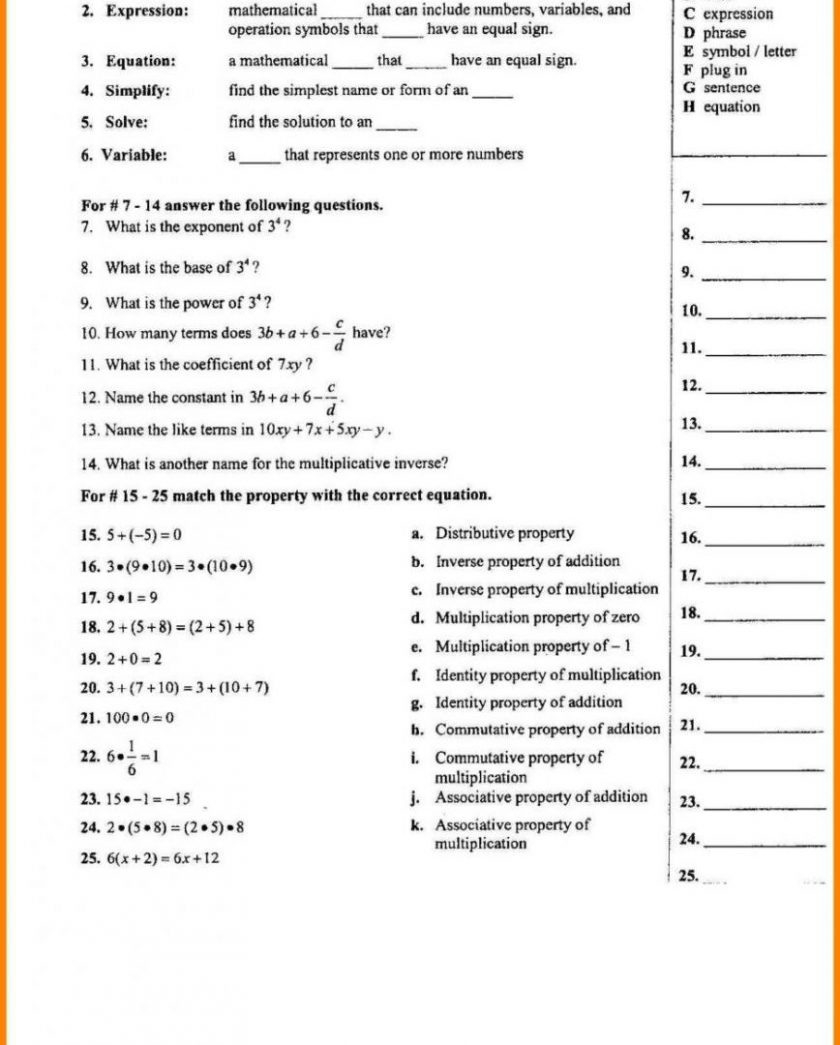

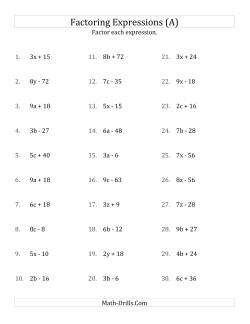

Preview text Property And Valuation Mathematics: Time Value Of Money An Introduction Why Do We Need Financial Do understand that the value of a dollar moves in time. Free Algebraic Properties Calculator - Simplify radicals, exponents, logarithms, absolute values and complex numbers step-by-step.

0 kommentar(er)

0 kommentar(er)